Have your mortgage payments gone up with each hike in the prime rate? Or have they stayed put? It’s important to know the difference between variable rate payment types — and their effect on your budget and mortgage goals.

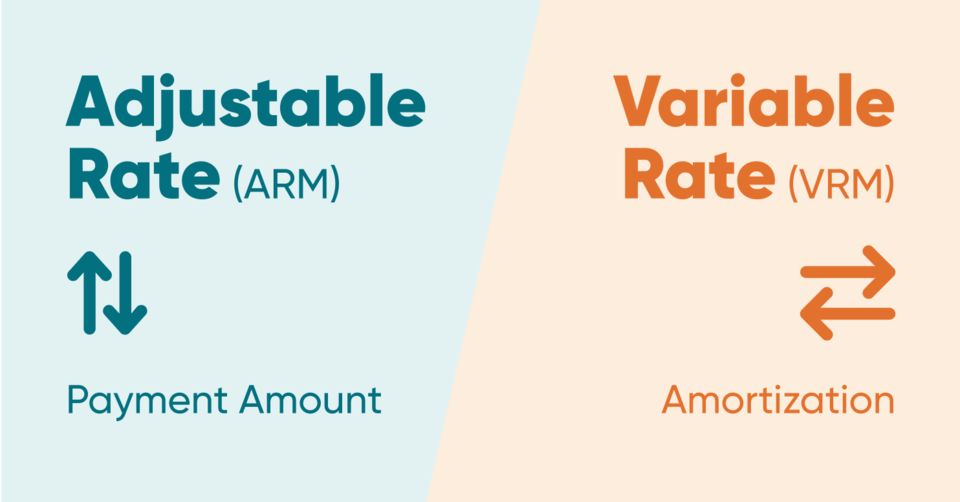

There are two types of variable rate mortgages.

The most common type, the Adjustable-Rate Mortgage (ARM), has a floating payment amount that rises and falls with changes in the prime rate. You pay the interest amount ‘as you go,’ and the amount going to your mortgage principal stays on track.

A Variable-Rate Mortgage (VRM), offered by some big banks, has static payments that stay the same despite rate changes. The ‘interest’ portion within the payment rises and falls, pushing the 'principal' portion up or down. If rates go up, your amortization quietly (and perhaps quickly) starts to tick up because your mortgage isn’t being paid down according to your original rate and payment agreement.

Is the ARM better than the VRM?

That depends on your mortgage goals. You chose a variable rate to save more over a typically higher fixed rate. To ensure your savings remain intact, the ARM keeps paying down your mortgage on schedule. You might renew at a different variable rate at the end of your term, but you won’t have to deal with an increased amortization. So, the ARM is all about your mortgage staying on course — even though you have to adjust your monthly budget along the way.

The VRM’s static payments, however, put your monthly budget on a pedestal. The trade off is that if rates go up and stay up, this setup can take a bigger bite out of your budget than you planned when it’s time to renew (or sooner, if you hit your trigger rate and the lender contacts you). You’ll have to squeeze that increased amortization into higher payments and pay more interest, unless you can pay a lump sum sufficient enough to make up the difference.

So the VRM has an added risk during a time of rate increases. Your monthly budget may be shielded temporarily from upward jolts, but you can face even higher payments and interest costs later — essentially negating any lower variable rate savings you were aiming for in the first place.

Find out your best mortgage rate in Ontario for free here.

Choosing an ARM may save you more than money.

True North Mortgage’s CEO and Founder, Dan Eisner, believes that the ARM is the better product to save money, time and stress — by keeping your mortgage savings on track. “When rates go up, your payments are gradually increasing, allowing you time to adjust your budget, versus the potential VRM 'big payment shock' that may await you at renewal time," he states. "Plus, you're more likely to keep your variable-rate savings intact, without the risk of increasing your interest costs through the static-payment vehicle.”

Even so, some clients still prefer a VRM.

The thing with mortgage rates? They go up, but they can also come down. A VRM can be a good choice if rates are going down, because then more of your payment goes towards your principal to pay off your mortgage faster.

Whether an ARM or a VRM, it’s important to get expert advice to know your product’s features — for a variable rate mortgage you can live with (read more about how you can save with an adjustable-rate mortgage here).

Don’t assume you have the right variable product for your situation.

No matter what product your lender puts in front of you, read the fine print. Many first-time home buyers especially may assume they have one payment type, only to be surprised when rates go up.

Better yet, talk to a True North Mortgage broker. Compared to a big bank or trendy mortgage website, their expert brokers are highly trained to help you determine your risk appetite for a variable rate product and the right solution for your savings goals. You’ll get unbeatable 5-star service that saves you time and stress, and you’ll have a go-to mortgage relationship during a time of rate volatility.

Real people who care, True North’s brokers are standing by to provide you with the best service in the industry, at no cost or obligation. Visit their website or apply now.

They're standing by to help. Canada’s No. 1 Mortgage Broker.