Sports trading card company Topps is combining with a special purposes acquisition company in a deal valued at $1.3 billion and seeking a public listing.

Topps Co. said Tuesday that it will join with Mudrick Capital Acquisition Corp., which will make a $250 million investment. Other investors include GAMCO Investors and Wells Capital Management.

Former Disney CEO Michael Eisner will continue as Topps chairman. His firm, The Tornante Co., which bought Topps in 2007, will roll all of its equity into the new public company, which will keep the name Topps.

The combined company will be led by Michael Brandstaedter, president and CEO of Topps.

The news follows a spate of similar SPAC deals, including WeWork less than two weeks ago.

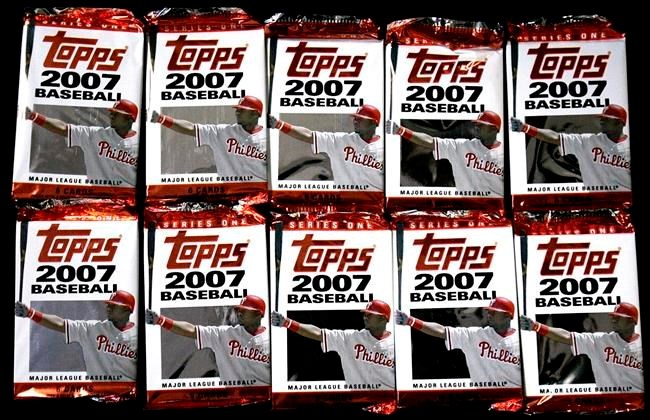

Topps, which sells trading cards, stickers and albums and trading card games, has numerous sports partners, including Major League Baseball, Major League Soccer, UEFA, Bundesliga, the National Hockey League and Formula 1. It also has deals with Disney and World Wresting Entertainment. The 80-year-old company had sales of $567 million last year.

The deal is expected to close late in the second or early in the third quarter, subject to approval from Mudrick shareholders. It will remain listed on the Nasdaq but will have the new ticker symbol, “TOPP."

Michelle Chapman, The Associated Press