A Guelph landlord says his family is on the brink of financial ruin due to a nasty dispute with the tenant of his rental property that has lasted over a year.

The tenant puts much of the blame on the landlord and has filed for bankruptcy, delaying attempts to evict them.

And everyone is angry.

Allegations go back and forth. The landlord claims nearly $45,000 in unpaid rent and the tenant insists payments were made, mostly in cash, with promised receipts never materializing. While proof of e-transfers was provided, there was no proof of cash payments proided.

Then there’s the foul-mouthed text messages, allegations of potentially criminal behaviour and fraud that flew back and forth over the past few months.

Both say they’ve called the police.

Any money owed by the tenant was essentially wiped clean when they filed for bankruptcy amidst eviction proceedings at the Landlord Tenant Board (LTB).

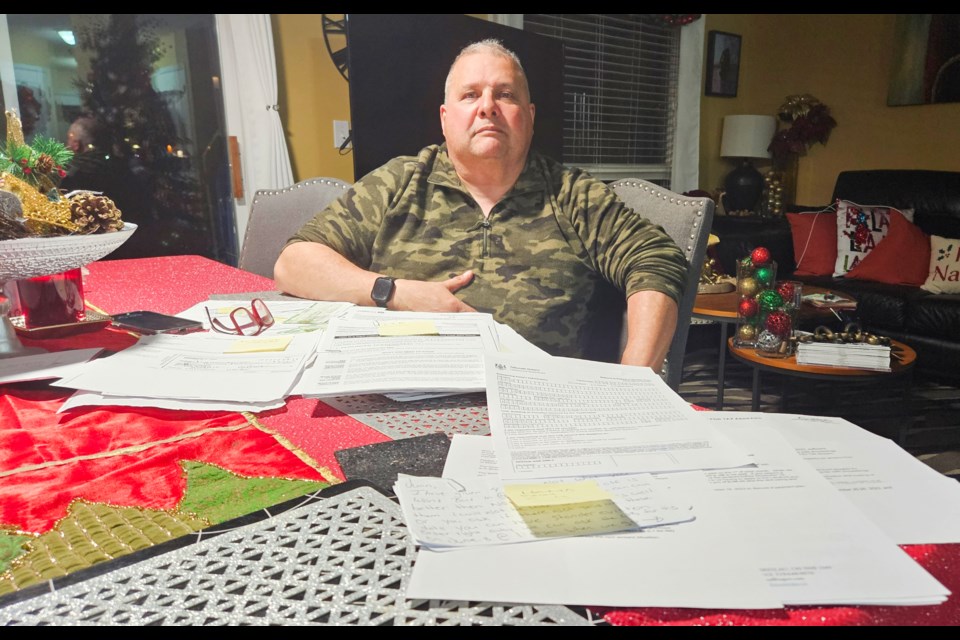

But the debt remains for Juan Monterroza who is on the hook for missing mortgage payments and unpaid property taxes, both of which could result in him losing the rental property bought in hopes of helping pay for his children’s university education.

The Bank of Montreal filed a lawsuit seeking full payment of nearly $900,000 owing on the home and threatening to reclaim the house if it doesn’t get it. The city has started the ball rolling on seizing the house to recoup $10,548 in unpaid property taxes.

“It’s a nightmare … People suffer, my family suffers. We don’t have money,” said Monterroza, who bought the rental home with his wife, Yesenia. “Bank rules in Canada erase it, all the money she owed me. And according to the law, she has to (be allowed to) stay in the home.”

The Monterrozas immigrated to Canada from Colombia during the 1970s, settling on the east side of town and raised two children who are now in their university years.

In 2022, a friend accepted a job in the United States and needed to sell their south end home quickly. The Monterrozas decided to buy it in hopes of turning a profit they could put toward paying for their children’s education costs.

But that plan quickly changed after the tenant moved into the rental home in mid-July of 2022.

Monterroza said the tenant paid first and last month’s rent, but he’s seen little else since. After several months of alleged non-payment of rent, he applied to the LTB for an eviction hearing.

“The landlord board is useless,” said Monterroza, lamenting the extensions and additional opportunities granted to the tenant to prove their bankruptcy claim.

“That shouldn’t happen,” he added of allegedly losing out on nearly $45,000 in rent money. “That needs to be stopped.”

However, the tenant, whose name is being withheld from this article due to unrelated safety concerns, feels the LTB documents don’t tell the whole story.

Since bankruptcy was already in the works, they didn’t feel a need to dispute the landlord’s non-payment accusations. They also opted not to follow through with plans to make allegations of their own regarding e-transfer payments, a demanded change to the day rent is paid (from the 15th of each month to the first) and concerns about inappropriate cheque-cashing, as well as put forward what they believe is evidence of harassment from the landlord.

“I was just so done with it all,” the tenant said. “You know how I protected myself, I claimed bankruptcy.”

Bankruptcy paperwork shown to GuelphToday indicates the filing covered the debt claimed by Monterroza as well as one other.

Furthermore, the tenant alleges Monterroza entered the home uninvited on at least one occasion and may be responsible for slashed tires on their car.

The tenant also insists they’ve been left to pay for things that are identified in the lease as covered by the landlord – gas and laundry facilities.

Since the LTB eviction notice was put on hold, Monterroza said the tenant is already two more months behind on rent, which isn’t covered by the bankruptcy filing. He’s applied to the LTB for a new eviction hearing focused on the recent lack of payment, but that’s not scheduled to happen until August.

With another LTB process underway, the tenant claimed to be making rent payments to the board for it to hold onto.

In the meantime, he’s looking to sell the rental property. There have been nibbles, he said, but no bites.

“Nobody wants the house because the people no pay rent,” Monterroza said, noting it’s been on the market for about six months. “So many people go to see the house because it’s a good house, it’s a good spot.”

Real estate photos of the property suggest its well-maintained and Monterroza made no claim to the contrary.

Though individual circumstances may differ, lingering disputes with tenants and months-long delays at the LTB have inspired “lots of landlords” to get out of the rental business, said Rose Marie, vice-chair of the Small Ownership Landlords of Ontario (SOLO), of which Monterroza is a member.

“It is common. The more we talk about it, it seems to be getting a little more frequent,” she said of people not paying their rent. “The problem is actually pretty prevalent.”

Such situations can leave landlords feeling stressed out because their mortgage, property taxes and utility payments must still be made.

“A lot of our landlords have to go to doctors for medication because they can’t sleep at night,” noted Marie.

She estimates that since 2020, landlords throughout the province have collectively lost about $4.6 billion in unpaid rent, based on her review of arrears applications filed with Tribunals Ontario, which includes the LTB.

SOLO, along with the more than 5,000 landlords it represents, is calling on the provincial government to make changes to the LTB.

It wants to see an automated eviction process put in place in order to avoid the need for some hearings, along with the prioritization of cases involving “professional tenants” – those who have repeatedly stopped paying rent in the past.